152 views admin 2025-12-31

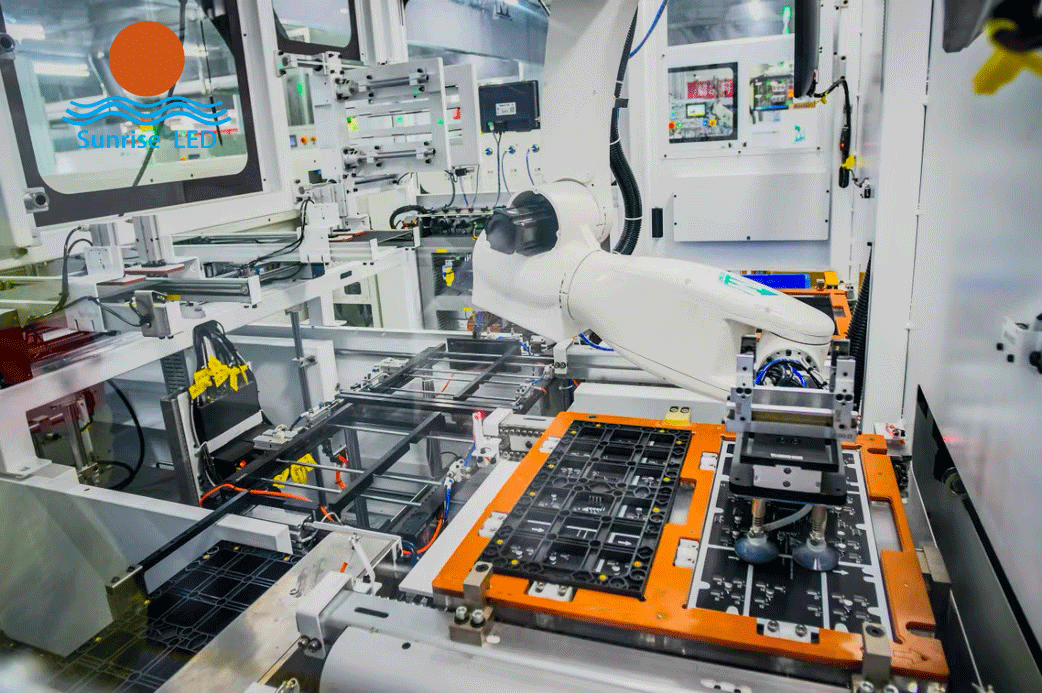

Micro LED technology has taken a crucial step towards commercialization, with pixel pitch successfully breaking through the 0.1-millimeter mark, achieving a "seamless splicing" display effect. It has been applied in high-end scenarios such as command centers and XR virtual production. Notably, the breakthrough in mass transfer technology has become the core support. Domestic mass production lines have achieved a yield rate of 99.995% for this technology, laying a solid foundation for the large-scale application of Micro LED.

Micro LED technology has taken a crucial step towards commercialization, with pixel pitch successfully breaking through the 0.1-millimeter mark, achieving a "seamless splicing" display effect. It has been applied in high-end scenarios such as command centers and XR virtual production. Notably, the breakthrough in mass transfer technology has become the core support. Domestic mass production lines have achieved a yield rate of 99.995% for this technology, laying a solid foundation for the large-scale application of Micro LED.

The innovation of packaging technology has also boosted industrial upgrading. Thanks to advantages such as uniform heat dissipation, high reliability and consistent light emission, COB (Chip-on-Board) packaging technology has seen a continuous increase in its proportion in small-pitch products. This technology can accommodate multiple LED chips on a single substrate, effectively reducing glare and adapting to high-power application scenarios, leading to a surge in demand in smart lighting and other fields. At the same time, MIP (Mini LED in Package) technology realizes micron-level chip arrangement through mass transfer process, further advancing the commercialization of Micro LED.

The innovation of packaging technology has also boosted industrial upgrading. Thanks to advantages such as uniform heat dissipation, high reliability and consistent light emission, COB (Chip-on-Board) packaging technology has seen a continuous increase in its proportion in small-pitch products. This technology can accommodate multiple LED chips on a single substrate, effectively reducing glare and adapting to high-power application scenarios, leading to a surge in demand in smart lighting and other fields. At the same time, MIP (Mini LED in Package) technology realizes micron-level chip arrangement through mass transfer process, further advancing the commercialization of Micro LED.

The in-depth integration of intelligence and networking has upgraded displays from "information presentation" to "spatial interaction". The introduction of AI algorithms has endowed LED displays with multiple functions such as dynamic content optimization, intelligent dimming and energy consumption management. The popularization of 5G-A networks has enabled real-time transmission of 8K videos and multi-screen collaborative interaction, creating immersive experiences in large-scale events, smart venues and other scenarios.

Market Differentiation: Steady Overall Growth with Mixed Performance Across Segments

The global LED display market maintained stable operation in 2025, with significant differentiation observed in regional markets and segmented tracks. The growth vitality of emerging markets and the development potential of high-end niche segments are particularly prominent.

In terms of overall scale, industry institutions estimate that the global LED display market size will grow slightly to 7.5 billion US dollars in 2025. By region, emerging markets such as Latin America and Southeast Asia have delivered outstanding performance, becoming new engines of industry growth driven by accelerated infrastructure construction and consumption upgrading demands. In contrast, terminal demand growth in developed European and American regions has been relatively sluggish due to factors such as tariff policies. According to quarterly data, global shipments of LED video display products increased by 8.3% year-on-year in Q3 2025, with revenue rising 6.9% year-on-year. Driven by the strong performance in regions such as the Middle East, Africa, Asia and Oceania, the overall market has maintained steady growth, demonstrating the resilience of the industry.

The in-depth integration of intelligence and networking has upgraded displays from "information presentation" to "spatial interaction". The introduction of AI algorithms has endowed LED displays with multiple functions such as dynamic content optimization, intelligent dimming and energy consumption management. The popularization of 5G-A networks has enabled real-time transmission of 8K videos and multi-screen collaborative interaction, creating immersive experiences in large-scale events, smart venues and other scenarios.

Market Differentiation: Steady Overall Growth with Mixed Performance Across Segments

The global LED display market maintained stable operation in 2025, with significant differentiation observed in regional markets and segmented tracks. The growth vitality of emerging markets and the development potential of high-end niche segments are particularly prominent.

In terms of overall scale, industry institutions estimate that the global LED display market size will grow slightly to 7.5 billion US dollars in 2025. By region, emerging markets such as Latin America and Southeast Asia have delivered outstanding performance, becoming new engines of industry growth driven by accelerated infrastructure construction and consumption upgrading demands. In contrast, terminal demand growth in developed European and American regions has been relatively sluggish due to factors such as tariff policies. According to quarterly data, global shipments of LED video display products increased by 8.3% year-on-year in Q3 2025, with revenue rising 6.9% year-on-year. Driven by the strong performance in regions such as the Middle East, Africa, Asia and Oceania, the overall market has maintained steady growth, demonstrating the resilience of the industry.

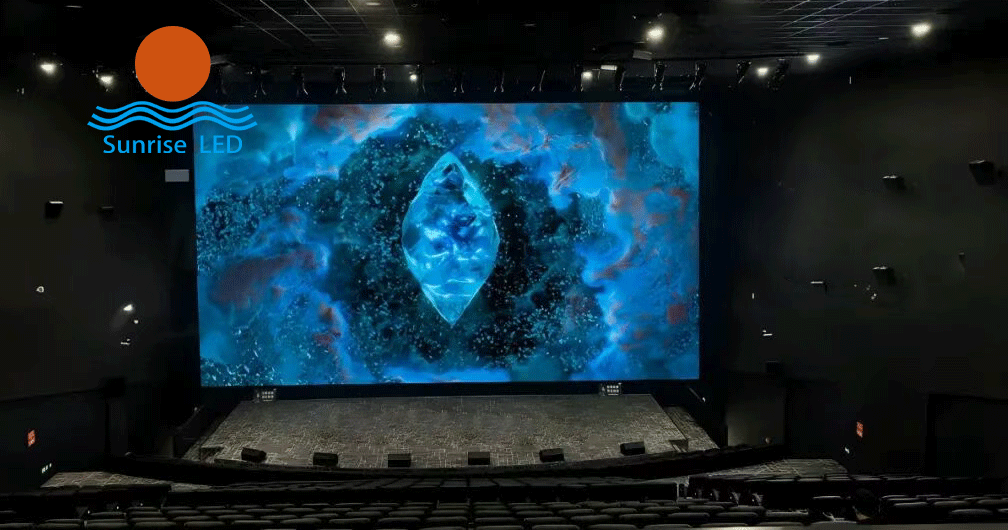

The differentiation across segmented tracks is more pronounced, presenting a pattern of "the strong getting stronger and high-end segments breaking through". LED all-in-one machines emerged as a growth highlight throughout the year. Benefiting from the demand pull of overseas conference and education markets, their shipments have maintained continuous growth, and the market concentration has kept rising. LED cinema screens have accelerated their deployment under the dual drive of policies and content. Increased domestic policy support and declining costs have boosted shipments; in overseas markets, demand has grown steadily relying on the promotion of HDR content, further driving up its penetration rate.

The rental market has shown the characteristics of "overall contraction and active high-end segments". Affected by the overall economic environment, demand for ordinary rental services has declined, but the high-end rental market still attracts industry attention due to stable profit margins, especially with strong demand in scenarios such as large-scale sports events and cultural entertainment activities. The outdoor market has maintained stable operation. LED outdoor screens with 10,000-nit brightness have become the focus of the market as they meet the all-weather display needs, and are widely used in urban landscape lighting, commercial advertising and other fields.

The differentiation across segmented tracks is more pronounced, presenting a pattern of "the strong getting stronger and high-end segments breaking through". LED all-in-one machines emerged as a growth highlight throughout the year. Benefiting from the demand pull of overseas conference and education markets, their shipments have maintained continuous growth, and the market concentration has kept rising. LED cinema screens have accelerated their deployment under the dual drive of policies and content. Increased domestic policy support and declining costs have boosted shipments; in overseas markets, demand has grown steadily relying on the promotion of HDR content, further driving up its penetration rate.

The rental market has shown the characteristics of "overall contraction and active high-end segments". Affected by the overall economic environment, demand for ordinary rental services has declined, but the high-end rental market still attracts industry attention due to stable profit margins, especially with strong demand in scenarios such as large-scale sports events and cultural entertainment activities. The outdoor market has maintained stable operation. LED outdoor screens with 10,000-nit brightness have become the focus of the market as they meet the all-weather display needs, and are widely used in urban landscape lighting, commercial advertising and other fields.

Competition Restructuring: Industrial Chain Integration and Differentiated Global Layout

The competitive landscape of the LED display industry is undergoing profound changes in 2025. Vertical integration of the industrial chain has become the core competitiveness, the differentiated competition between international brands and local enterprises has intensified, and regional market strategies have shown diversified differentiation.

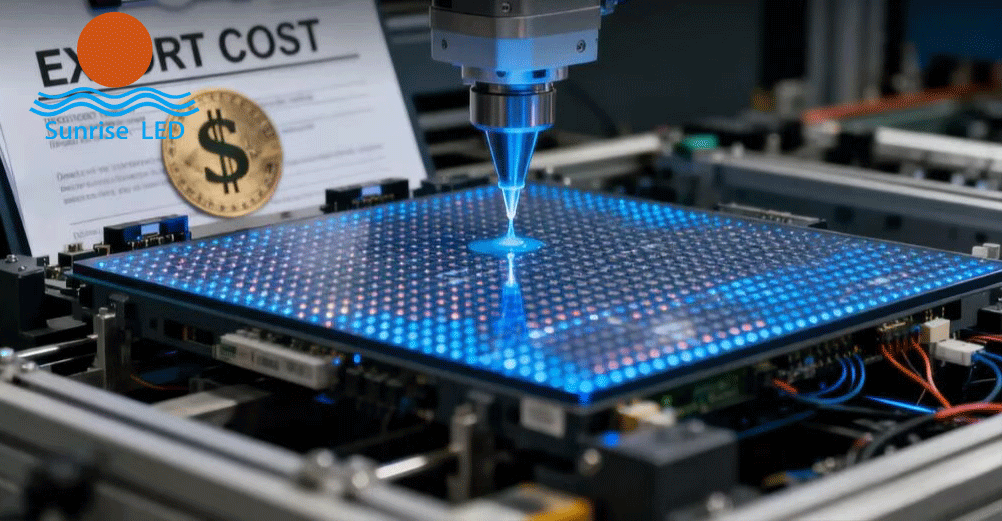

The trend of vertical integration of the industrial chain is remarkable. Through the full industrial chain layout of "chips - packaging - display modules", enterprises can effectively control costs, ensure supply chain stability and strengthen core competitiveness. Especially in cutting-edge technology fields such as Mini/Micro LED, the full industrial chain layout can accelerate technological iteration and commercialization, becoming the core strategic direction of leading industry players. At the same time, the division of labor in the industrial chain has become more clear, and the living space of small and medium-sized enterprises has been further compressed.

International brands and local enterprises have formed a differentiated competitive pattern. Relying on technological patent barriers in the Micro LED field, international brands occupy an advantageous position in the high-end market, especially building "moats" in key technical links such as core materials and driving architectures. Local enterprises, by virtue of their full industrial chain advantages and cost control capabilities, have rapidly risen in the mid-to-high-end market. Meanwhile, they are actively improving product added value through technological upgrading to get rid of the predicament of low-price competition.

Regional market strategies have shown obvious differentiation. Emerging markets such as Southeast Asia and the Middle East have become core engines for export growth of local enterprises. By means of localized production and establishing regional supply chains, enterprises can effectively avoid trade barriers and enhance market penetration. The domestic market focuses on technological upgrading and brand building. By launching high-end products and providing integrated solutions, enterprises are responding to fierce price competition and promoting the transformation of the industry towards high-quality development.

Competition Restructuring: Industrial Chain Integration and Differentiated Global Layout

The competitive landscape of the LED display industry is undergoing profound changes in 2025. Vertical integration of the industrial chain has become the core competitiveness, the differentiated competition between international brands and local enterprises has intensified, and regional market strategies have shown diversified differentiation.

The trend of vertical integration of the industrial chain is remarkable. Through the full industrial chain layout of "chips - packaging - display modules", enterprises can effectively control costs, ensure supply chain stability and strengthen core competitiveness. Especially in cutting-edge technology fields such as Mini/Micro LED, the full industrial chain layout can accelerate technological iteration and commercialization, becoming the core strategic direction of leading industry players. At the same time, the division of labor in the industrial chain has become more clear, and the living space of small and medium-sized enterprises has been further compressed.

International brands and local enterprises have formed a differentiated competitive pattern. Relying on technological patent barriers in the Micro LED field, international brands occupy an advantageous position in the high-end market, especially building "moats" in key technical links such as core materials and driving architectures. Local enterprises, by virtue of their full industrial chain advantages and cost control capabilities, have rapidly risen in the mid-to-high-end market. Meanwhile, they are actively improving product added value through technological upgrading to get rid of the predicament of low-price competition.

Regional market strategies have shown obvious differentiation. Emerging markets such as Southeast Asia and the Middle East have become core engines for export growth of local enterprises. By means of localized production and establishing regional supply chains, enterprises can effectively avoid trade barriers and enhance market penetration. The domestic market focuses on technological upgrading and brand building. By launching high-end products and providing integrated solutions, enterprises are responding to fierce price competition and promoting the transformation of the industry towards high-quality development.

Coexisting Challenges: Breaking Development Bottlenecks and Seeking Growth Drivers

Although the LED display industry has made many breakthroughs in technology and market in 2025, it still faces multiple challenges such as overcapacity, price competition and uncertain trade environment. The industry is addressing these bottlenecks through diversified strategies and seeking new growth drivers.

Overcapacity and irrational competition have become the primary challenges of the industry. Affected by factors such as the continuous expansion of COB production capacity and the increase of new entrants, the industry has shown a clear oversupply situation, product prices have continued to decline, some projects have fallen into severe involution, and the profit margins of enterprises have been greatly compressed. At the same time, the industry also faces problems of lack of standards and compliance issues. Some non-3C certified non-compliant products have flowed into the market, which not only pose potential safety hazards, but also damage the overall reputation of the industry. In this regard, the industry calls for an end to involution, the implementation of quality compliance and operational compliance, and the achievement of development through technological innovation rather than low-price competition. At the enterprise level, companies are improving their risk resistance capabilities through measures such as technology stratification, optimizing cost structures and focusing on high-end niche markets.

The uncertainty of the trade environment has exacerbated export pressure. External barriers such as US "reciprocal tariffs" have impacted export business, especially affecting the demand release of high-end application scenarios. To address this challenge, enterprises are actively advancing the market diversification strategy and increasing efforts to develop emerging markets. Meanwhile, they are expanding application scenarios through technological iteration, deeply integrating LED display technology with sports, cultural tourism and other fields to cultivate new growth poles.

Coexisting Challenges: Breaking Development Bottlenecks and Seeking Growth Drivers

Although the LED display industry has made many breakthroughs in technology and market in 2025, it still faces multiple challenges such as overcapacity, price competition and uncertain trade environment. The industry is addressing these bottlenecks through diversified strategies and seeking new growth drivers.

Overcapacity and irrational competition have become the primary challenges of the industry. Affected by factors such as the continuous expansion of COB production capacity and the increase of new entrants, the industry has shown a clear oversupply situation, product prices have continued to decline, some projects have fallen into severe involution, and the profit margins of enterprises have been greatly compressed. At the same time, the industry also faces problems of lack of standards and compliance issues. Some non-3C certified non-compliant products have flowed into the market, which not only pose potential safety hazards, but also damage the overall reputation of the industry. In this regard, the industry calls for an end to involution, the implementation of quality compliance and operational compliance, and the achievement of development through technological innovation rather than low-price competition. At the enterprise level, companies are improving their risk resistance capabilities through measures such as technology stratification, optimizing cost structures and focusing on high-end niche markets.

The uncertainty of the trade environment has exacerbated export pressure. External barriers such as US "reciprocal tariffs" have impacted export business, especially affecting the demand release of high-end application scenarios. To address this challenge, enterprises are actively advancing the market diversification strategy and increasing efforts to develop emerging markets. Meanwhile, they are expanding application scenarios through technological iteration, deeply integrating LED display technology with sports, cultural tourism and other fields to cultivate new growth poles.

In summary, 2025 is a year of "coexisting challenges and opportunities" for the LED display industry. Looking forward to the future, the industry will continue to evolve towards high-end, intelligent and scenario-oriented directions. For enterprises, only by firmly grasping core technologies, deeply cultivating segmented scenarios and advancing global layout can they break through in fierce competition. The transformation from "manufacturing" to "solutions" is not only the key for enterprises to improve added value, but also the only way for the industry to achieve high-quality development and reconstruct the value system. The technological breakthrough in 2025 has illuminated the path ahead, and the future industry restructuring is even more worth looking forward to.

In summary, 2025 is a year of "coexisting challenges and opportunities" for the LED display industry. Looking forward to the future, the industry will continue to evolve towards high-end, intelligent and scenario-oriented directions. For enterprises, only by firmly grasping core technologies, deeply cultivating segmented scenarios and advancing global layout can they break through in fierce competition. The transformation from "manufacturing" to "solutions" is not only the key for enterprises to improve added value, but also the only way for the industry to achieve high-quality development and reconstruct the value system. The technological breakthrough in 2025 has illuminated the path ahead, and the future industry restructuring is even more worth looking forward to.

At present, the naked eye 3D large screen market is hot, and 3D technology is also known as 3D di...

Sunrise’s p2.604 curved LED display lights up under the Eiffel Tower Sunri...

Concert activities are popular in the United States, and sunrise’s products have been wide...

Sunrise 264 square meters Galaxy 3115 series mesh led facade in Armenia Sun...

Doris, as a new salesman, won three orders in two months. It’s great. Jack, the bu...

640w and 800W full spectrum led grow light It can be folded for convenient transportatio...

The latest project, Saudi Arabia LED MESH FACADE. Ultra-high brightness, ultra-light LED display ...